[ad_1] China this week blocked exports of two vital minerals used in computer chips and hi-tech products – triggering a global rush to source altern

[ad_1]

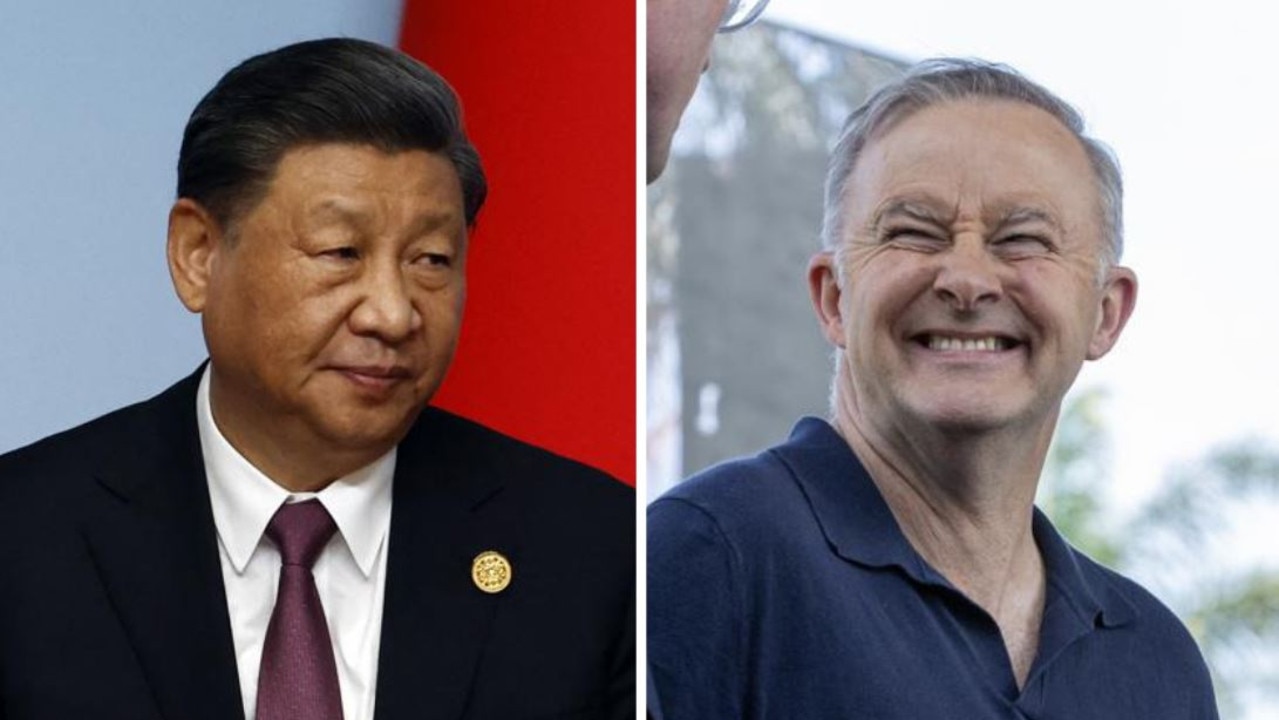

China this week blocked exports of two vital minerals used in computer chips and hi-tech products – triggering a global rush to source alternate supplies.

And Australia’s already positioning itself to secure a slice of the resulting “friend-shoring” market.

A leading Communist Party trade official declared the restrictions on gallium and germanium products were “just the start” of Chinese trade bans to protect “national security interests”.

Most of the world regards the move as a “tit-for-tat” retaliation against US-led moves to choke the sale of key technologies – including top-end computer chips – to China.

Just as Washington and Taipei dominate the chip manufacturing market, so too does Beijing over the rare earth and critical minerals supply chains.

And that’s raised fears more economically destabilising export bans are in the pipeline.

Gallium and germanium are just two out of 17 rare earth elements used to achieve the extreme performance and efficiencies needed in modern electric motors, turbines and batteries – as well as consumer electronics such as smartphones.

China’s mines account for 70 per cent of global production. And its processing facilities refine more than 85 per cent of the total supply.

Any cut to supply will trigger product shortages and higher prices.

But Beijing’s willingness to use these materials as economic bludgeons to enforce its diplomatic ambitions has resulted in multinational businesses seeking alternative sources.

“China’s tactics are not merely an assortment of cutthroat moves made by individual actors,” says former US National Security Council China director Liza Tobin.

“Rather, they are features of Beijing’s long-term strategy and are backed up by the full force of the country’s party-state system, creating a challenge that (we) cannot afford to ignore.”

And Australia is marketing its democratic – and diplomatic – stability as a major selling point for investment in securing new supplies.

“When it comes to resources critical to security, Australia possesses immense advantages,” says Geopolitical Futures director of analysis Allison Fedirka.

“After China, Australia is arguably the next most significant player in critical minerals mining and technology, which makes it a vital partner for Western powers.”

Brute force economics

Beijing has a history of government intervention in global supply chains to meet its political agendas.

“The litany of specific practices is long: market access restrictions in strategic sectors, massive subsidies that fuel domestic overcapacity and enable Chinese firms to wipe out foreign competition, requirements for foreign firms to transfer technology in order to access the Chinese market, economic coercion, intellectual property theft, cyber- and human-enabled espionage, and forced labour,” argues Ms Tobin.

“China’s brute force economics playbook puts competing firms out of business and destroys entire industries in rival nations.”

The desired goal is to make the world reliant on Chinese supplies. And that reliance makes the world vulnerable to Beijing’s coercion tactics, she adds.

Now, Beijing is extending its diplomatic toolkit to its mineral processing power.

“Of particular concern is the country’s emergence as a dominant player in a growing number of strategic industries such as steel, aluminium, solar panels, wind turbines, electric vehicle batteries, high-speed rail, commercial drones, telecoms network equipment, and even energetic materials that power missiles and rockets,” says Ms Tobin.

But it’s not the first time Beijing has weaponised mineral supplies.

In 2010, it cut exports of rare earths to Japan to coerce Tokyo into surrendering its claim over the Senkaku Islands in the East China Sea. Instead, Japan invested heavily in Australian producer Lynas to find alternative supplies for producing high-end magnets.

Lynas was once again the go-to alternative for the US Department of Defence, which in 2021 awarded it a $120 million contract to build a new processing plant in Texas to ease reliance on Chinese facilities.

Similar moves are now being planned worldwide.

“While China might believe it is winning with such tactics, the measures against economic coercion announced at the May G-7 meeting in Japan prove that the world is taking note and responding accordingly,” argues Fulbright Scholar Misha Zelinsky in Foreign Policy.

Of de-risking and decoupling

“These actions underscore the need to diversify supply chains,” a US Department of Commerce spokesperson said of Beijing’s new bans this week.

“The United States will engage with our allies and partners to address this and to build resilience in critical supply chains.”

Here Australia hopes to cash in on its decision to back security arrangements with Washington over economic ties with Beijing.

“In addition to supporting the security of its allies, doing so would provide Australia with several benefits,” says Ms Fedirka.

“First, it would reduce Australia’s own vulnerability to Chinese coercion. Second, by moving more value-added activities onshore, it would increase Australia’s export revenues.”

But there’s a reason China has cornered the rare earth and critical mineral markets.

Refining them is a dirty process. The minerals are found in low concentrations. And they’re generally all mixed together among radioactive elements like uranium and thorium.

The chemical process of separating the minerals produces considerable amounts of toxic waste.

But now Australia, Canada and the US have introduced policies to subsidise and support the establishment of refining plants to support their own minerals sectors.

It’s a move expected to produce a backlash from Beijing.

“On questions of sovereignty or core national interest, you can’t skirt core issues or change binary facts by being more polite,” says Mr Zelinsky.

“A no will always be a no. Either you’re happy to let Huawei build your 5G network, or you’re not. Same goes for Chinese bases in the Pacific.

“And one thing we know for sure: China doesn’t take bad news well.”

Australian implications

“De-risking” is a tactic Beijing is adopting for itself.

And Australia is its target.

China is heavily subsidising domestic iron ore production to “decouple” itself from Australia’s largest export market. And it has initiated a significant investment campaign in “friendly” alternate iron ore suppliers in Africa and South America.

But, just as it found alternative markets for products banned under Beijing’s punitive economic sanctions, Australia aims to capitalise upon this new round of coercive trade restrictions.

Vietnam, Russia and Brazil have about 20 million tonnes of rare earth deposits each. India has 6.9 million, and the United States has 2.3 million.

Calculations for Australia project 4.2 million tonnes of supply. But more than 80 per cent of the country is yet to be surveyed for deposits.

Canberra expects new critical minerals experts to boost the budget bottom line by $71 billion and create 115,100 jobs by 2040.

“However, if Australia processes and refines more of its critical minerals at home, the government expects this could add $133.5 billion to the country’s GDP and create 262,600 more jobs,” says Ms Fedirka.

“This increased wealth would help fund other national efforts, like Australia’s defence initiatives.”

But multinational corporations have recognised this potential and are moving to secure ownership and supply agreements for a large share of Australia’s critical minerals, she adds.

“This could threaten the prospects of current and future Australian minerals processors and manufacturers,” she says.

“Yet by increasing its domestic downstream capabilities, Australia will be able to ensure its domestic supply and better monitor and regulate exports to ensure they are not endangering its strategic and energy security.”

Jamie Seidel is a freelance writer | @JamieSeidel

[ad_2]

Source link

COMMENTS