[ad_1] Hordes of Asia’s billionaires have lost vast sums amid a crisis in China’s property industry, with some losing as much as three-quarters of t

[ad_1]

Hordes of Asia’s billionaires have lost vast sums amid a crisis in China’s property industry, with some losing as much as three-quarters of their fortunes.

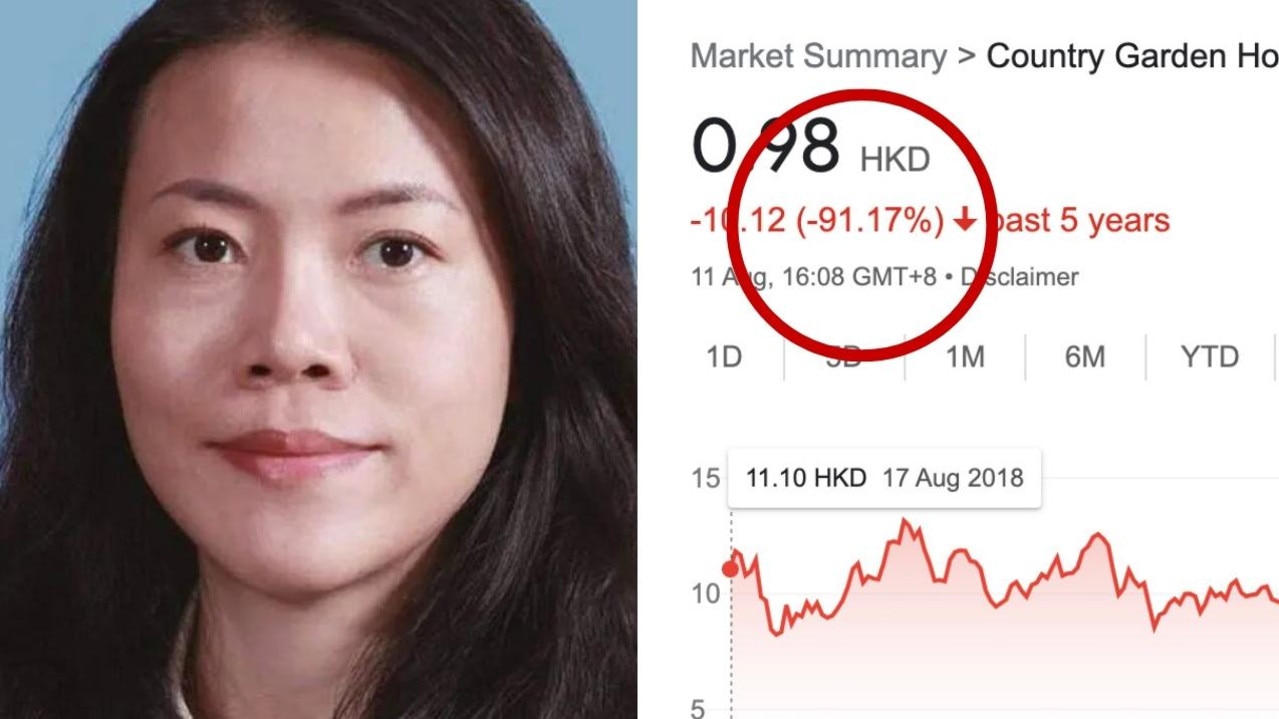

Yang Huiyan, chair of property development firm Country Garden Holdings and once the richest woman in Asia, lost more wealth than any other billionaire in the world in just over two years amid her company’s soaring debts, according to Nine newspapers.

According to the Bloomberg Billionaires Index, Ms Yang’s fortune has plummeted by a staggering 84 per cent since its peak in June 2021, including a drop of 8.2 per cent on Tuesday alone. It amounts to a fall of $44 billion, leaving Ms Yang with a fortune of about $8.4 billion.

Country Garden missed annual interest payments on its bonds, which were due on Monday, meaning it’s on course for its first public default if it doesn’t pay up within a 30-day grace period.

The company’s share price has fallen by almost 60 per cent this year.

Country Garden is just one of several property empires in turmoil after the Chinese government cracked down on excessive borrowing in the property industry.

Ms Yang’s fall from grace comes after, earlier this year, it was revealed fellow Chinese property tycoon Wang Jianlin’s net worth had tumbled by more than 85 per cent.

Mr Wang, sometimes called China’s answer to Walt Disney, founded the shopping, entertainment and hotel empire Dalian Wanda Group.

He was once Asia’s richest person but, by June, his fortune had dwindled by $40 billion from its peak, to $6.6 billion.

Bloomberg, citing unnamed sources, reported Mr Wang’s executives were reaching out to smaller lenders, having been turned away by China’s biggest banks.

Further, China’s property industry doesn’t look set for a quick rebound.

“For the last 10 years, the property companies expanded too fast with too much debt,” Louis Tse, managing director at brokerage firm Wealthy Securities, told Bloomberg at the time.

“The good old days are gone for good, especially for Chinese property billionaires.”

[ad_2]

Source link

COMMENTS