[ad_1] A billionaire business tycoon known as China’s answer to Walt Disney has had his net worth slashed by $40 billion in a devastating blow. Wang

[ad_1]

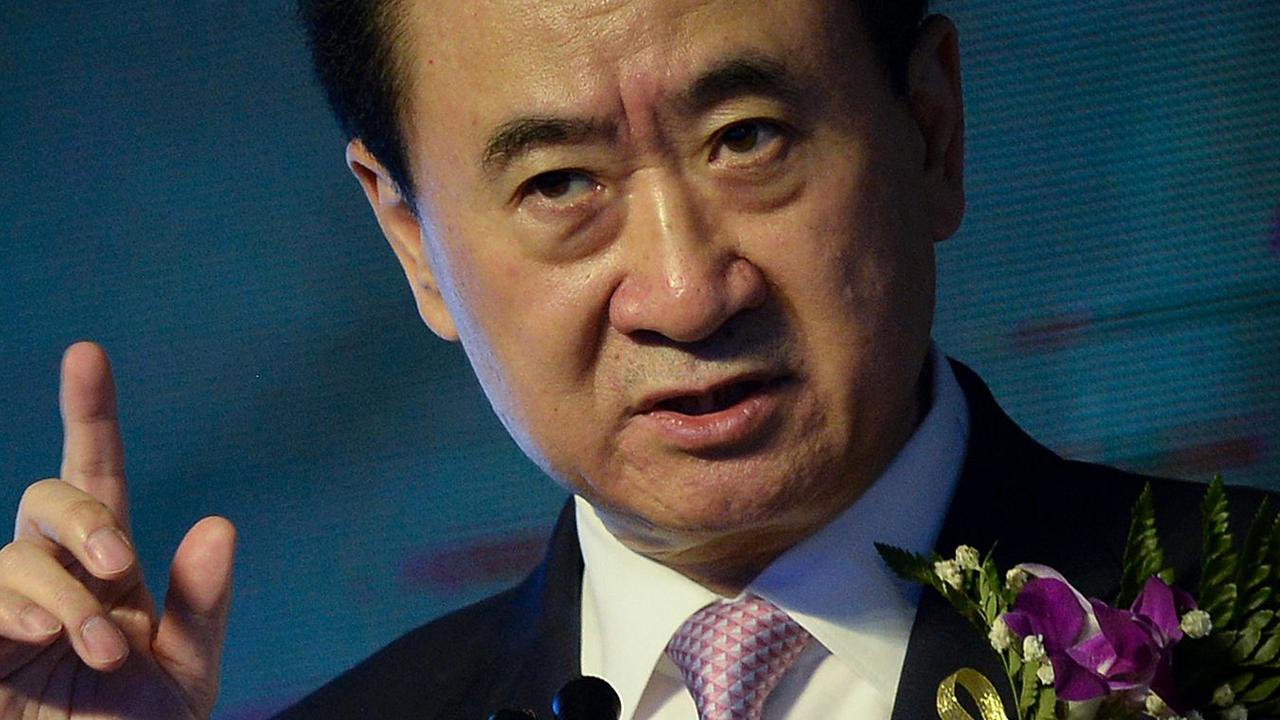

A billionaire business tycoon known as China’s answer to Walt Disney has had his net worth slashed by $40 billion in a devastating blow.

Wang Jianlin, the founder of Dalian Wanda Group, was once Asia’s richest person but his fortune has dwindled by $40 billion from its peak to $6.6 billion — a crash of more than 85 per cent.

The property and entertainment tycoon has suspended all new business initiatives as he tries to stop the bleeding and rally support for his conglomerate, which is facing billions of dollars in debt, according to Bloomberg.

He is in the midst of a ferocious fight to save what’s left of the 35-year-old shopping, entertainment and hotel empire that he hoped would become China’s answer to Walt Disney Co.

Bloomberg, citing unnamed sources, reported that Wanda executives were reaching out to smaller lenders, having been turned away by China’s biggest banks.

Wang, 68, acknowledged some of the problems at his embattled company during a meeting in April, but maintained that it would recover, the publication reported.

The billionaire has acted quickly before to save Wanda, rescuing the company from the brink of bankruptcy five years ago by selling a slew of hotels, tourism hot spots and theme parks to its competitors.

Looking at the big picture, though, Wang’s current crisis is a poignant illustration of the immense problems that have engulfed China’s property sector.

The industry was brought to its knees by the country’s strict Covid-19 lockdowns and pummelled further by its reopening earlier this year, which resulted in the biggest Covid outbreak the world had ever seen.

Further, China’s property industry doesn’t look set for a quick rebound.

“For the last 10 years, the property companies expanded too fast with too much debt,” Louis Tse, managing director at brokerage firm Wealthy Securities, told Bloomberg.

“The good old days are gone for good, especially for Chinese property billionaires.”

The number of Chinese billionaires plummeted by a fifth last year, the largest fall in the 24 years since the rich list began.

The Hurun Rich List revealed in November that the number of Chinese billionaires dropped by about 20 per cent from 1185 to 946, while their total wealth also fell by 18 per cent.

Hurun Report chairman and chief researcher Rupert Hoogewerf said China’s billionaires had been hit hard in 2022, experiencing nine of the top 10 biggest wealth shrinkages across the world.

“E-commerce platforms, real estate, education, generic drugs and vaping were the hardest hit,” Mr Hoogewerf said at the time.

“The recent Covid outbreak across the country and increased tension with the US combined … to see the steepest drop in value since the 2008 financial crisis, with many of China’s biggest companies shedding up to half their value.

“Other factors in play include continued anti-monopoly regulations, pressure on real estate borrowings, efforts to stem the falling birthrate, carbon emission targets and the recently introduced common prosperity theme.”

[ad_2]

Source link

COMMENTS