[ad_1] Time is running out for the US to resolve its debt crisis, with the nation now set to run out of cash within days.Tense negotiations are curr

[ad_1]

Time is running out for the US to resolve its debt crisis, with the nation now set to run out of cash within days.

Tense negotiations are currently under way in Congress regarding the debt ceiling – the legislated amount of debt the US Federal Government can have outstanding – which currently sits at $US31.4 trillion ($A46.8 trillion) after being set in 2021 and reached this January.

Democrats want it to be raised immediately, while Republicans are pushing for a range of conditions such as spending cuts to be met before agreeing to lift the self-imposed borrowing cap.

If a deal to raise the debt ceiling is not reached soon, America could default – for the first time ever – as soon as June 1, according to Treasury Secretary Janet Yellen, who said it would cause “an economic catastrophe” both in the US and across the planet.

So far, negotiations have stalled, with Democrats accusing Republicans of holding the American people hostage and playing politics with people’s livelihoods.

And as the world’s largest economy, a US default would send shockwaves across the world that would be inescapable for us all.

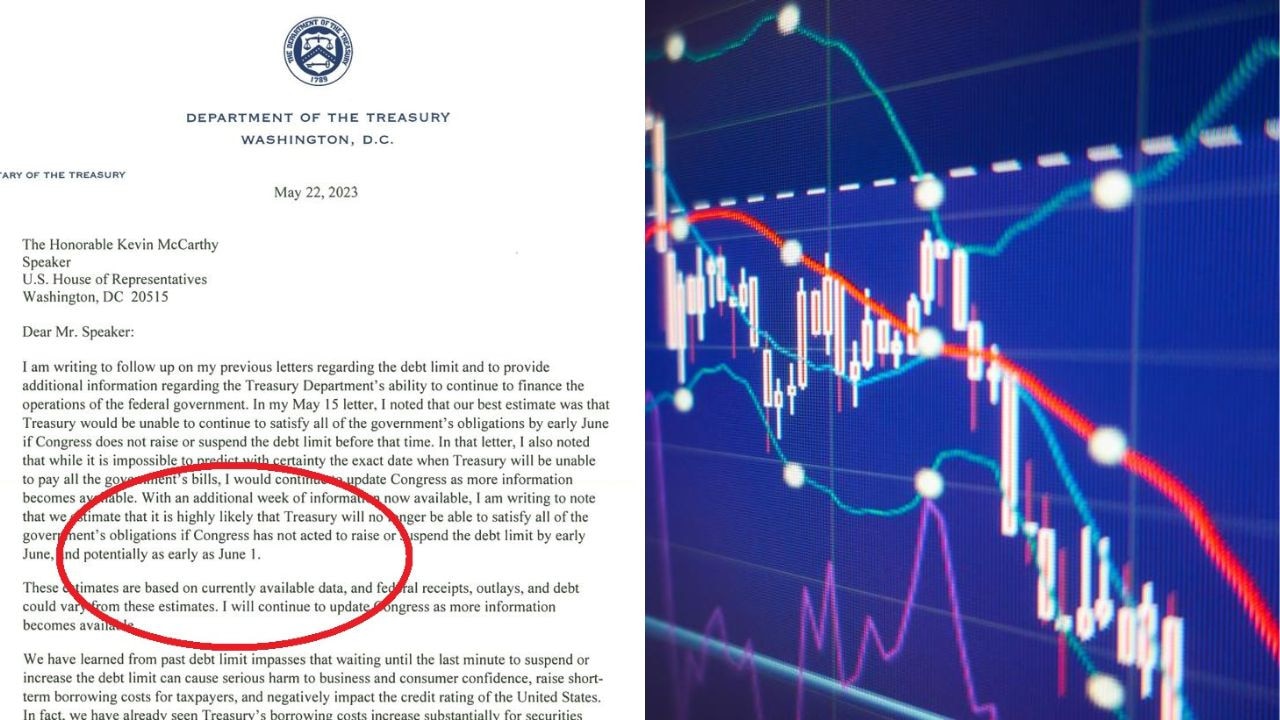

In a new letter to House Speaker Kevin McCarthy on Monday, Ms Yellen claimed it was now “highly likely” that doomsday would hit on June 1 – the so-called “X-date” when the government would no longer be able to pay its bills and would default.

“With an additional week of information now available, I am writing to note that we estimate that it is highly likely that Treasury will no longer be able to satisfy all of the government’s obligations if Congress has not acted to raise or suspend the debt limit by early June, and potentially as early as June 1,” she wrote.

“We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States.

“If Congress fails to increase the debt limit, it would cause severe hardship to American families, harm our global leadership position and raise questions about our ability to defend our national security interests.”

In recent months, the Treasury has been using extraordinary measures to help the US government continue to pay its bills. The “X-date”, which is the date when the government can no longer pay its bills, is rapidly approaching. If America were to default, it could spark a worldwide recession which would impact Australia along with the rest of the globe.

It would also send interest rates soaring, lead to millions of job losses and crash the housing market.

But while there have been tentative signs of progress in recent days, Mr McCarthy, who is set to meet with US President Joe Biden today, said “nothing is agreed to” yet.

Mr Biden, who has just returned from a G7 summit in Japan after cancelling a planned trip to Australia as a result of the debt crisis, has also come out swinging, blaming pro-Donald Trump Republicans for effectively holding the economy hostage in an effort to scupper his chances of re-election in 2024.

“I think there are some MAGA Republicans in the House who know the damage it would do to the economy, and because I am President, and a President is responsible for everything, Biden would take the blame and that’s the one way to make sure Biden’s not re-elected,” he said in Japan of the ongoing debacle.

Since 1960, the US debt ceiling has been lifted 78 times.

[ad_2]

Source link

COMMENTS